The Decommissioning Affair: Life at the End

With this energy transition expecting to witness the shut down of several fossil fuelled plants, projects that were once commissioned to serve the energy market will have to be dismantled.

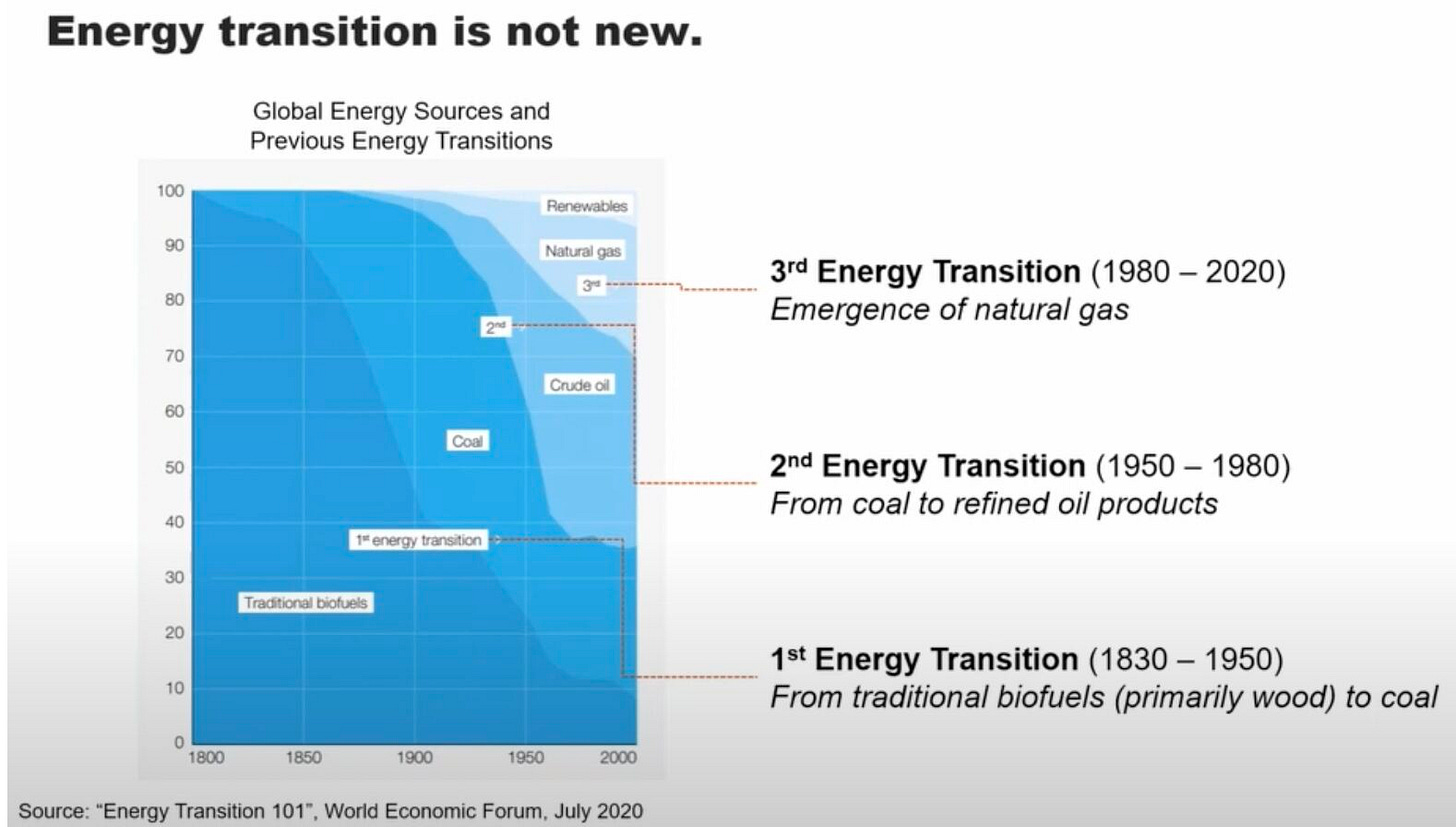

Investment necessary for infrastructure to accommodate this energy transition is expected to cost $3.1 trillion and $5.8 trillion annually on average until 2050. The opportunities that come with this transition seems enormous, definitely higher than energy transitions from previous centuries. Yes, this is not the first energy transition and possibly it will not be the last (see image below for more on the energy transition across the history of time), but this is our planets’ fourth energy transition.

While this energy transition, this move from fossil-based fuel to more sustainable energy systems is expected to erupt the energy market with new technologies – there is another sheriff in town, It’s decommissioning.

What Goes up Comes Down…

Decommissioning is simply to put out of service, of assets. The process involves clearing, where applicable filling the well, removing platforms and everything else you could imagine with a nuclear plant, oil or gas wells infrastructure. Decommissioning projects depending on the energy plant much like commission can be technical, with long decommissioning periods and where possible cash value from sale of high valued components.

Although fossil fuel plants and resource sites are closed or shut-down, for the most part, they are not at a end-of-life phase as commonly described - but rather an important part of the circular economy1 triggered by the energy transition. It’s an opportunity and possibly one that takes a significant part of the financing for infrastructure in this energy transition.

How do you know a decommissioning project is successful?

By how purposeful the site (and components) will become – so, it’s pertinent that companies and national governments involved in relative projects are set with rules and regulations to assist this other multi-trillion-dollar economy.

The Business of Decommissioning

Decommissioning might seem to complete the ‘out with the old’ narrative, but it’s more than that. Roles within the let’s call it, the Decommissioning market have expanded over the years’ from project financing to Policy regulating, then sustainable architecture, engineering for re purposing and Surveying. There is an annual spending projected of $13 billion within the next 25 years for technical decommissioning specialists.

In the North Sea alone, there are over 100 oil installations with roughly 10,000 km of pipeline and thousands of wells. Each one of these will eventually reach the end of their production cycle (if not accelerated by this energy transition) and will require decommissioning.

One environmental company which gave me a close insight on the potential market for decommissioning as early as 2016 was this women owned and led company based in California. Blue Latitude works to re-purposing offshore oil and gas platforms as reefs.

While this phase of decommissioning is focused on the fossil fuel project, it’s also important that the industry is mindful of the next transition. New energy, renewable energy technologies on an average have a 20 year life span, decommissioning happens next….just food for thought.

The market for decommissioning is relevant now, as it would be for decades ahead.

Till next time,

Oghosa

‘A circular economy is an economic model designed to minimize resource input, as well as waste and emission production. Circular economy aims to reach the maximum efficiency in the use of finite resources, the gradual transition to renewable resources, and recovery of the materials and products at the end of their useful life’ Circular Economy - Overview, Principles, Types of Cycles (corporatefinanceinstitute.com)

Very informative, Oghosa! interesting read...